On 23 February 2024, ADQ (Abu Dhabi-based investment and holding company) announced a plan for investing $35 billion in Egypt, which is the biggest in Egypt’s history.

Of this amount, $24 billion will be used to acquire development rights Ras El-Hekma, located approx. 350km northwest of Cairo. The Egyptian government will retain a 35% stake in the development. The remaining $11 billion will be used to invest in other prime projects in Egypt.

Prime Minister Madbouly expects the investment to come in two tranches:

i. $15bn within a week comprising of $5bn already deposited at the Central Bank of Egypt (CBE) and fresh dollars of $10bn

ii. $20bn within 2 months comprising $6bn deposited with CBE and $14bn in fresh dollars

This is well in excess of market expectations and well above the requirements of the International Monetary Fund (IMF) under their original funding program.

Goldman Sachs and Morgan Stanley have provided insightful analysis regarding this investment on Egypt’s North Coast.

Here are the key points from their reports:

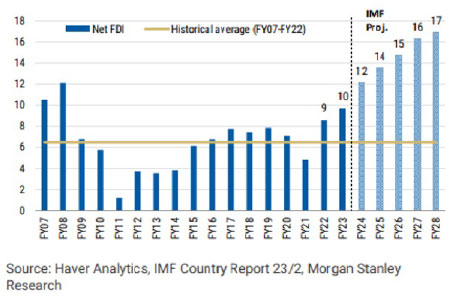

- IMF Programme and Policy Implications: The deal aligns with Egypt’s IMF programme objectives, particularly in shifting towards more stable FDI funding. It is seen as a crucial step towards unlocking a larger IMF loan, potentially exceeding $10 billion, and achieving a more favourable FX adjustment.

- FX Inflows: The investment will result in $24 billion in fresh FX inflows over the next two months, which is expected to provide sufficient liquidity to clear the FX backlog and stabilize the FX market in Egypt.

- FX Adjustment Expectations: The deal is expected to pave the way for a long-awaited adjustment in foreign exchange (FX) rates, which is seen as a key policy step to secure a larger IMF loan. A significant reduction in the parallel market rate for USD/EGP is anticipated, potentially reaching levels of 40-45 EGP per USD.

- Comparison to Previous Inflows: The deal’s magnitude is compared to Egypt’s past FDI inflows, with the $35 billion amounting to more than three years’ worth of net FDI inflows in only two months, as well as around 9% of the country’s GDP.